Welcome to the exciting world of personal finance! Whether you’re a seasoned investor or a beginner at the start of your financial journey, understanding personal finance is crucial in enhancing your wealth and achieving your monetary goals. In today’s fast-paced world, money matters can often seem complex and overwhelming. Fear not! With the right knowledge, tools, and strategies, you can navigate this labyrinth with ease. This blog post is designed to demystify personal finance and guide you in making informed financial decisions that will pave the path toward financial freedom. So buckle up and get ready to elevate your personal finance game!

What is personal finance?

Diving deep into personal finance, it becomes apparent that its importance spans much more than just handling money. It involves a comprehensive understanding of financial concepts, the discipline to apply financial skills, and an effective strategy to meet life’s goals and aspirations. Personal finance is a continuous journey of making and adjusting plans based on evolving life situations. It’s about creating a budget, making long-term financial plans, understanding the implications of taxes, making investment decisions, and ensuring insurance coverage. Sound personal finance habits contribute significantly to financial independence, security, and overall well-being. It’s a crucial life skill that everyone should learn and master.

Why is personal finance important?

Understanding the importance of personal finance extends to the crucial task of managing various aspects of one’s financial life. This includes not just making money, but also saving money, building wealth, and protecting assets. Effective management of personal finances involves creating a budget, tracking expenses, and investing wisely to build wealth. Protecting assets, on the other hand, entails securing the right insurance policies and planning for retirement.

However, the complexity of personal finance can often be overwhelming, leading many individuals to delay making financial decisions. This delay can result in missed opportunities for accumulating wealth and securing one’s financial future. The multifaceted nature of personal finance requires continuous learning, planning, and adaptation, but the rewards are well worth the effort. It is therefore essential to overcome any apprehension and take proactive steps towards understanding and managing your personal finances. Taking control of your financial life is not just empowering, it is a necessity for financial security and freedom.

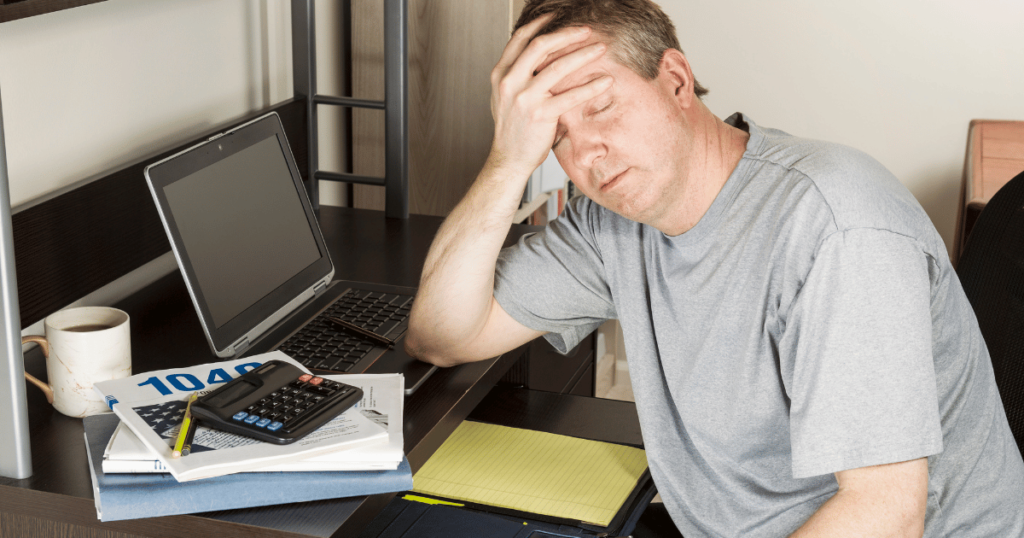

10 Fundamental elements of personal finance

Now that we’ve covered the basics, let’s delve into the practical aspects of enhancing your wealth through personal finance. The following sections will guide you through the process of budgeting, saving, investing, and planning for retirement. We’ll provide tips, strategies, and resources that can help you make the most of your income, grow your wealth, and secure your financial future. Understanding these fundamental aspects of personal finance is pivotal to achieving financial success. Let’s get started!

1. Making money

The cornerstone of wealth creation lies not just in making money, but also in how we manage it. One key concept in personal finance that plays a pivotal role in making money is frugality. Being frugal is more than just being stingy or cheap – it’s about making the most out of what you have. Frugality is understanding the value of money, recognizing the difference between needs and wants, and making thoughtful decisions about spending and saving. By practicing frugality, you can keep more of what you make, setting the stage for wealth accumulation.

But how does one make money? There are several ways to generate income, ranging from traditional employment to entrepreneurship, investments, and passive income strategies. A significant part of financial management involves exploring these avenues, assessing their potential returns, and balancing them against their associated risks. Remember, diversification is fundamental when it comes to making money. By having multiple income streams, you can ensure a steady cash flow, build your wealth, and improve your financial security.

2. Saving money

Saving money is integral to personal finance. It lays the foundation for future investments, emergency funds, and financial security. The common forms of savings include savings accounts, fixed deposits, government bonds, and money market funds. These forms vary in terms of interest rates, risk levels, accessibility, and maturity periods.

Interestingly, having too much savings can be viewed as a bad thing. While it may seem counterintuitive, excessive savings could indicate underutilization of money that could otherwise be invested for higher returns. Savings accounts generally offer relatively low interest rates, which may not keep up with inflation, causing the purchasing power of your savings to erode over time. Therefore, a balanced approach of saving and investing is usually advised.

3. Managing money

Managing money effectively is a fundamental aspect of personal finance and involves strategic planning and disciplined execution. A key strategy in managing money is minimizing costs. This involves conscious spending habits and making a deliberate effort to reduce unnecessary expenses. It’s not about depriving yourself, but rather about making wise and thoughtful decisions that align with your financial goals. Techniques such as using a budgeting app, automating savings, and leveraging discounts and cashback can help in stretching your dollar further. It’s also crucial to understand the concept of ‘paying yourself first’, which means allocating a portion of your income towards savings before spending on anything else. This approach promotes consistent saving and helps build a healthy financial cushion. Remember, effective money management is not about how much you earn; it’s about how well you manage what you earn.

4. Borrowing money

Borrowing money is a significant component of personal finance and involves careful consideration of several factors. When borrowing, it’s essential to understand the purpose of the loan, assess your repayment capacity, and select the right type of loan based on your needs. A key element to consider is the interest rate, which is the cost of borrowing money. It can vary widely among different types of loans, so it’s crucial to compare rates before borrowing.

There are several types of loans available, including personal loans, home loans, auto loans, student loans, and credit card loans. Each loan type has unique features, terms, and conditions. For instance, home loans usually have lower interest rates but longer repayment terms, while credit card loans have high-interest rates and short repayment terms.

5. Building a budget

Building a budget is an integral step towards successful financial management and it begins with understanding one’s relationship with money. It’s crucial to evaluate how you view and interact with money, as this relationship will influence how you allocate your funds in your budget. Building a budget involves detailing your income and expenses, and then making necessary adjustments to ensure that your income covers your expenses, contributes to savings, and allows for financial growth.

Personal finance apps, like Quicken Deluxe, have revolutionized the way we approach budgeting. They allow users to track their income and expenses with ease, providing valuable insights into spending habits. Leveraging past data, these apps can help you create a model for your future spending, enabling you to adjust and plan accordingly.

6. Maximizing your credit cards

The importance of maximizing your credit cards cannot be overstated in the realm of personal finance. By selecting a card that best fits your spending habits and credit situation, you can enjoy several benefits including cash back, rewards, discounts, and even travel miles. The key to maximizing credit cards lies in understanding your spending patterns, identifying the type of rewards that would bring the most value to you, and ensuring that the cost of maintaining the card (like annual fees) doesn’t outweigh the benefits. It’s also crucial to manage your credit card use responsibly to maintain a healthy credit score.

In our endeavor to guide you in selecting the best credit card, we form partnerships with various credit card companies. However, these partnerships influence neither our evaluation of the products nor our commitment to providing unbiased advice. Our reviews and recommendations are driven solely by our desire to help you make an informed decision that aligns with your financial goals. Rest assured, we prioritize your interests and financial success above all.

7. Paying off debt

Paying off debt is a vital part of personal finance management and overall financial health. It’s not just about freeing up funds that are being allocated to repayments, but also about liberating yourself from the economic and emotional burdens associated with long-term debt. There are several strategies that can effectively assist in paying off debt. These include the ‘snowball method’, where you start by paying off smaller debts first to create momentum, and the ‘avalanche method’, where you focus on paying off the debt with the highest interest rate first.

Creating a debt payoff plan can significantly aid in this process. It provides a clear roadmap, outlining what you owe, to whom, and by when, thereby enabling you to track your progress over time and stay motivated. Moreover, it allows you to strategize your payments to minimize interest and expedite the debt repayment process.

8. Taxes

Grasping the intricacies of federal income tax is critical to effective personal finance management. Knowledge of how taxes work not only ensures compliance with the law but also enables optimal financial decisions, potentially saving individuals considerable sums of money.

Understanding and effectively managing your federal income tax can lead to significant financial benefits. It provides a clearer picture of your total income after tax, enabling more accurate budgeting and financial planning. Moreover, it can help you identify opportunities for tax savings and avoid potential penalties and interest related to underpayment of taxes.

9. Investing

Investing is an essential aspect of personal finance. Investments serve as a tool to grow one’s wealth, provide income during retirement, or meet specific financial goals. They are a testament to the saying, “make your money work for you.” Investing means placing your money in vehicles with the potential for profitable returns through interest, income, or appreciation in value. However, it’s important to note that with potential rewards come inherent risks.

The primary types of investments include stocks, bonds, mutual funds, and real estate. Stocks represent ownership in a corporation, providing potentially high returns but also carrying significant risk. Bonds, on the other hand, are more stable and involve lending money to an entity (government or corporate) for a fixed period, earning interest over that period. Mutual funds allow you to pool your money with other investors to invest in a diversified portfolio of stocks, bonds, or other assets, managed by a professional. Real estate investment involves buying property for rental income or capital appreciation.

10. Retirement Planning

Retirement planning is an essential aspect of personal finance that carries immense significance for long-term financial security. The process involves setting retirement income goals and making decisions to reach them. It typically includes considerations about spending habits, saving, investing, and managing assets, and often involves setting aside funds in dedicated retirement accounts such as 401(k)s or IRAs.

The benefits of robust retirement planning are manifold. Firstly, it provides financial independence in your later years when regular employment income might cease. Additionally, it allows for a comfortable lifestyle in retirement, helping ensure you have the funds necessary to maintain your standard of living and afford healthcare costs. It also provides peace of mind, reducing financial stress and uncertainty about the future. Lastly, effective retirement planning can lead to a meaningful legacy, allowing you to provide for your loved ones or contribute to causes you care about. By prioritizing retirement planning, individuals can ensure they are well-prepared for the future, enabling them to enjoy their retirement years to the fullest.

Conclusion

In conclusion, personal finance is a vital aspect of daily life. It involves managing your money effectively to achieve financial stability and security in the short and long term. By creating a budget, maximizing credit cards, paying off debt, understanding taxes, making informed investments, and planning for retirement, individuals can take control of their finances and work towards achieving their financial goals. While there is no one-size-fits-all solution, it’s essential to educate oneself and seek professional guidance when needed to make the best financial decisions for one’s unique situation. With proper personal finance management, individuals can improve their financial well-being and pave the way for a more secure future. So, it’s crucial to prioritize personal finance and proactively work towards achieving financial success. Remember, it’s never too late to start working towards your financial goals. Begin today and reap the benefits in the future!