In a rapidly evolving world, where technology is transforming every facet of our lives, the realm of personal finance is no exception. Among the notable innovations in this domain, the emergence of personal finance chatbots stands out prominently. These intelligent, automated assistants can simplify the managing of your finances and make them less intimidating. But how do they actually work? What benefits do they offer, and what limitations might they have? This blog post aims to explore these questions in detail, providing a comprehensive understanding of personal finance chatbots. Buckle up as we embark on this exploration of AI-powered financial management!

Related article: Personal Finance: Enhance Your Wealth

What is a Personal Finance Chatbot?

A Personal Finance Chatbot is an AI-driven tool designed to interact with users about their financial matters. These bots harness the power of machine learning and natural language processing to offer personalized financial advice, track expenditures, and even execute transactions on behalf of users. Leveraging a user-friendly interface, they can decode complex financial jargon into simple language, making financial management a less daunting task. Now, let’s delve deeper into how these chatbots function, their benefits, and potential limitations.

Benefits of a Personal Finance Chatbot

Personal finance chatbots provide myriad benefits, enhancing user experiences and giving a fresh perspective on managing finances. A significant benefit is their ability to personalize the user experience. Built on sophisticated artificial intelligence technologies, these chatbots can track your financial habits and transactions, analyze this information, and provide tailored financial advice based on your behavior. This level of customization not only makes financial planning more efficient but also promotes better financial habits.

By integrating a personal finance chatbot into your financial strategy, you can enjoy a user-friendly approach to manage your finances, track financial behavior, and make well-informed decisions. Using personal savings and assets to fund this initiative can also provide a safer and more committed route to business growth.

Understanding AI and Machine Learning

Before we delve deeper into the advantages and drawbacks of personal finance chatbots, it is imperative to comprehend the underlying technology that powers these tools – Artificial Intelligence (AI) and Machine Learning (ML). These technologies form the backbone of chatbots, enabling them to learn from user interactions, make data-driven decisions, and evolve over time. Let’s explore these concepts further under the following headings.

How AI Works in the Financial Sector

Artificial Intelligence (AI) has revolutionized the financial sector, acting as a true catalyst for change. Its transformative power lies in its unparalleled ability to swiftly process immense volumes of data. This capability has brought about unprecedented advancements, propelling the industry forward. This processing power enables AI in finance to identify patterns, trends, and anomalies that might go unnoticed by the human eye, thus providing valuable insights for decision-making.

A prominent manifestation of this is evident in the ability to predict future trends. Through the analysis of historical data and current market conditions, AI can forecast upcoming market trends with an unprecedented level of accuracy. This capability was previously unattainable, but now it empowers us to make informed decisions based on reliable insights. This predictive power is especially beneficial in areas such as investment planning and risk management, where anticipating future scenarios can lead to more informed and strategic decision-making.

Benefits of Using AI for Personal Finance

AI brings numerous benefits to personal finance management. Here are some key advantages that make AI a potent tool for personal finance:

- Personalization: AI, at its core, thrives on data. With continuous user interaction, it learns about individual financial habits, preferences, and goals, which allows for highly personalized financial advice and suggestions. It adjusts its recommendations based on changes in the user’s financial behavior or circumstances, making it a truly personalized financial assistant.

- Accessibility: AI-powered personal finance tools are accessible from anywhere at any time, offering users the convenience to manage their finances on their terms. This level of accessibility is a game-changer, particularly for individuals with limited access to traditional financial advice.

- Proactive Guidance: Unlike traditional financial tools that provide reactive advice, AI-powered systems offer proactive guidance. They can alert users about potential risks, upcoming payments, or investment opportunities, helping them stay ahead of their financial game.

- Enhanced Financial Literacy: AI systems use simple, jargon-free language to explain complex financial concepts to users, enhancing their financial literacy over time. They can also provide educational resources tailored to the user’s financial situation and goals.

- Automation: AI excels in automating repetitive, mundane tasks. From tracking expenses and categorizing transactions to setting up automatic payments, AI can handle a range of tasks, freeing up time for users to focus on strategic financial planning.

Limitations of AI in the Financial Sector

Despite the numerous benefits AI brings to the realm of finance, it is not without its limitations.

- Data Reliance: The precision of AI and machine learning models heavily depends on the caliber and volume of data they receive. Insufficient or biased data may result in flawed predictions and insights, potentially leading to financial missteps for the user.

- Lack of Human Touch: While AI systems can process and analyze data at unmatched speeds, they lack the human element that is often crucial in financial decision-making. Empathy, emotional intelligence, and personal relationships play a critical role in finance, especially when dealing with sensitive topics like personal finances.

- Regulatory Issues: AI applications in finance operate in a highly regulated environment, with laws and regulations varying across countries. The rapidly evolving nature of AI presents challenges in establishing and enforcing relevant regulations.

- Algorithmic Bias: If the data used to train AI models contains biases, these can be ingrained into the AI’s algorithms, leading to unfair outcomes. This is known as algorithmic bias. In the context of personal finance, this could result in discriminatory lending or investment practices.

- User Trust: Many users may be hesitant to entrust their financial management to an AI, particularly given the high stakes involved. This lack of user trust is a significant barrier to widespread adoption of AI in finance.

Types of Technology Used by Personal Finance Chatbots

Personal finance chatbots leverage a variety of cutting-edge technologies to provide their services. These technologies facilitate efficient communication, understanding and interpretation of user requests, decision-making, and the presentation of complex data in an accessible way. The sections below delve into the specific technologies often utilized by these chatbots: Natural Language Processing (NLP), Intent Recognition and Entity Extraction, Automated Reasoning and Decision Making Tools, and Data Visualization Tools.

Natural Language Processing (NLP)

Natural Language Processing (NLP) is a fascinating field of artificial intelligence that empowers computers to comprehend, interpret, and eloquently respond to human language. It enables machines to derive meaning and gain valuable insights from our interactions, bridging the gap between humans and technology. The core purpose of NLP is to break down the barrier between human communication and computer understanding, fostering a more intuitive and interactive interface.

In terms of applications, NLP is widely used in various technology-driven arenas such as search engines, voice-activated assistants, and translation services. More specifically to our topic of interest, personal finance chatbots adopt NLP to comprehend and respond to user’s queries or instructions articulated in natural language.

Intent Recognition and Entity Extraction

Intent Recognition and Entity Extraction are fundamental components of Natural Language Understanding (NLU), which is a subset of Machine Learning focused on interpreting human language. These processes enable chatbots, like those used for personal finance, to understand and act on user input effectively.

Intent recognition refers to the intricate process of discerning the underlying purpose or objective behind a user’s input. For instance, a user may ask a personal finance chatbot, “What was my spending on groceries last month?” The intent recognition component identifies the user’s goal, which in this case is to obtain information on previous grocery expenses. Intent recognition is typically achieved through supervised learning, where a model is trained on labeled data. Techniques such as deep learning and sequence classification are commonly used.

Entity Extraction, on the other hand, The process entails identifying and extracting targeted information or entities from the user’s text. In the above example, the entities would be “spending,” “groceries,” and “last month.” These entities help the chatbot understand the specific details the user is interested in. Various techniques such as rule-based methods, Conditional Random Fields (CRF), and more recently, Bidirectional Encoder Representations from Transformers (BERT) are used for entity extraction.

Automated Reasoning and Decision Making Tools

Automated reasoning and Decision-Making Tools form the backbone of AI’s ability to provide valuable insights in the realm of personal finance. Automated reasoning involves utilizing AI capabilities to draw valid conclusions based on a set of facts or data. These AI tools can parse through large volumes of financial data at unrivalled speed, identifying patterns or trends that might not be immediately apparent to humans. The extracted insights inform their decision-making processes, enabling them to provide users with tailored financial advice or recommendations.

These decision-making tools use AI algorithms to analyze a user’s financial data, including income, expenditures, savings, and investments. They can identify spending habits, evaluate investment portfolios, and assess financial risks, allowing them to make informed recommendations on budgeting, saving, investing, and other financial decisions. The ability of these AI-driven tools to analyze and learn from financial data continually ensures that their advice is not only accurate but also personalized. As a result, users of personal finance chatbots utilizing automated reasoning and decision-making tools can make more informed financial decisions, leading to better financial outcomes.

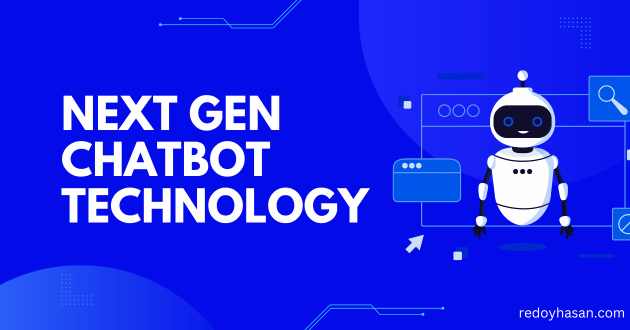

Data Visualization Tools

Data visualization tools play a critical role in presenting complex financial data in an easy-to-understand, graphical format. Personal finance chatbot users can effortlessly gain insights and make informed decisions with the aid of data visualization tools. Some of the well-known options include Tableau, Power BI, D3.js, Google Data Studio, and Plotly.

Tableau is widely recognized for its user-friendly interface and robust data visualization capabilities. It helps to translate raw data into easily digestible visual formats. Its features include the ability to handle vast amounts of data, real-time data analysis, and collaboration tools.

Power BI, a product of Microsoft, offers interactive visualizations, effortless data exploration, and robust data modelling tools. It seamlessly integrates with other Microsoft products, making it a go-to choice for organizations heavily invested in the Microsoft ecosystem.

D3.js is a JavaScript library known for its flexibility and control over the final visual result. Its strength lies in the ability to utilize web standards such as HTML, SVG, and CSS to create a wide array of dynamic and interactive data visualizations.

Google Data Studio is a comprehensive tool that integrates well with other Google services. It offers customizable reports, intuitive and user-friendly interfaces, and a wide range of chart types that cater to varied data representation needs.

Plotly, particularly popular among data scientists, supports a range of programming languages including Python, R, and Julia. It facilitates the creation of sophisticated and interactive visualizations and provides libraries for machine learning and statistical analysis, offering a comprehensive toolset for data analysis and visualization.

In summary, these data visualization tools, each with its unique features and functionalities, aid personal finance chatbots in delivering meaningful, digestible insights to users.

Advantages and Disadvantages of Using a Personal Finance Chatbot

As we delve deeper into the role of AI in managing personal finances, it’s critical to evaluate the merits and potential drawbacks of using personal finance chatbots. In the following sections, we’ll explore the advantages and disadvantages of employing these AI-driven assistants, providing a balanced perspective on their utility and areas for improvement.

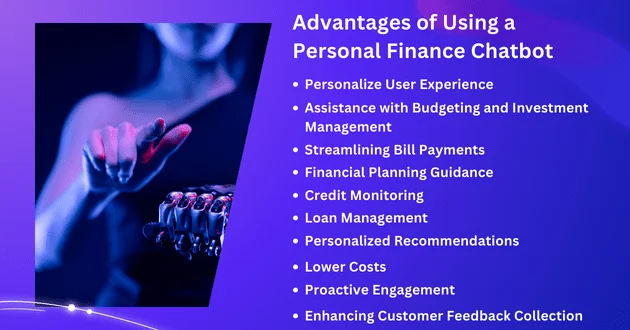

Advantages of Using a Personal Finance Chatbot

- Personalize User Experience: Personal finance chatbots leverage user data and AI algorithms to tailor their services to each user’s unique needs and preferences. By analyzing spending habits, income sources, and financial goals, these chatbots can provide personalized budgeting advice and investment recommendations.

- Assistance with Budgeting and Investment Management: Chatbots can help users create and adhere to budgets by tracking expenses and suggesting adjustments based on financial goals. Similarly, they can provide investment advice by analyzing market trends and risk factors, helping users to optimize their investment portfolios.

- Streamlining Bill Payments: These chatbots can remind users of upcoming bill payments, preventing late fees, and aiding in maintaining a good credit score. Some chatbots even facilitate direct bill payments through their platforms.

- Financial Planning Guidance: Chatbots can help users formulate comprehensive financial plans, incorporating aspects like savings, investments, retirement planning, and more. They can predict future financial scenarios based on current trends, helping users prepare for different eventualities.

- Credit Monitoring: Chatbots can monitor users’ credit scores and report changes, providing tips for improving credit health. They may also alert users to potential fraudulent activities identified on their accounts.

- Loan Management: Chatbots can help users understand different loan options, calculate interest, and manage repayments. This feature is particularly useful for users with multiple loans, as it aids in tracking and optimizing repayments.

- Personalized Recommendations: Based on user interactions and financial data, chatbots can offer personalized financial recommendations. This could include suggesting a savings plan, identifying unnecessary expenses, or recommending suitable insurance plans.

- Lower Costs: By automating tasks traditionally performed by human financial advisors, chatbots can provide cost-effective solutions. They’re available 24/7, eliminating the need for scheduling appointments and reducing wait times.

- Proactive Engagement: Chatbots can send proactive notifications about market trends, potential investment opportunities, or financial tips. This feature helps to keep users engaged and informed about their financial decisions.

- Enhancing Customer Feedback Collection: Chatbots can solicit and collect user feedback in real-time, which is crucial for improving services. Users can express their views and experiences freely, providing valuable insights for service improvement.

Disadvantage of Using a Personal Finance Chatbot

- Dependence on Internet Connectivity: Personal finance chatbots are entirely online-based. Users might face difficulties in accessing the chatbot services during network connectivity issues or in areas with poor internet service.

- Limited Understanding: Despite advancements in AI, chatbots sometimes may fail to comprehend complex queries or instructions, causing frustration for users. While suited to handle most standard scenarios, they might struggle with unique or unusual financial situations.

- Privacy Concerns: Chatbots require access to personal financial data, which might raise privacy concerns for some users. Safeguarding the security and privacy of delicate financial information poses a formidable challenge.

- Lack of Personal Touch: Chatbots may lack the ability to empathize with users’ situations, which can be a crucial element of financial advising. They cannot replace the human touch in financial advice, which often involves emotional and subjective factors.

- Regulatory Challenges: Compliance with financial regulations can be a challenge, especially given the continually evolving legal landscape around financial services and data privacy.

- Potential Errors: AI systems, including chatbots, aren’t error-free. Misinterpretation of user commands or data can lead to mistakes with potentially significant financial consequences.

- Training and Updating Issues: Chatbots need to be regularly updated and trained with the latest financial strategies, tax laws, and investment opportunities, which can be resource-intensive.

Conclusion

Personal finance chatbots offer numerous benefits, allowing users to access financial advice and management services at their convenience. However, they also have some limitations that must be addressed for widespread adoption and long-term success. As AI technology advances and regulations evolve, we can expect these chatbots to become more robust and user-friendly, providing even greater value to individuals looking for personalized financial solutions. So, while they may not fully replace human financial advisors, personal finance chatbots are a valuable tool for managing finances effectively and efficiently. As with any technology, it’s crucial to understand both the advantages and disadvantages before integrating them into our daily lives. With careful consideration and balance, personal finance chatbots can be a powerful ally in achieving our financial goals.